If you want to make an international wire transfer then you have to visit a Capital One bank branch and talk with a bank officer. Capital One only allows international wire transfer for their Essentials Checking, Essentials High-Yield, and Essentials Saving account holders. Wire transfers are real time transfers and costs more than ACH transfer (which takes 2-4 days for transfer of money). Domestic wire transfers are run through either the Fedwire system or the Clearing House Interbank Payments System. These include the convenience of paying bills or making payments in the country and the ease of direct deposits for employment or Social Security payments. citizens living abroad, referred to as expatriates or expats, maintaining checking and other bank accounts in the United States provides several advantages.

Sign Reseller Agreement signNow is a number one eSignature platform that helps users … Capital One NA Swift Codes for International Wire TransfersĪnd without a strong mobile platform and 24-hour help centers, it may be difficult to access funds when overseas.

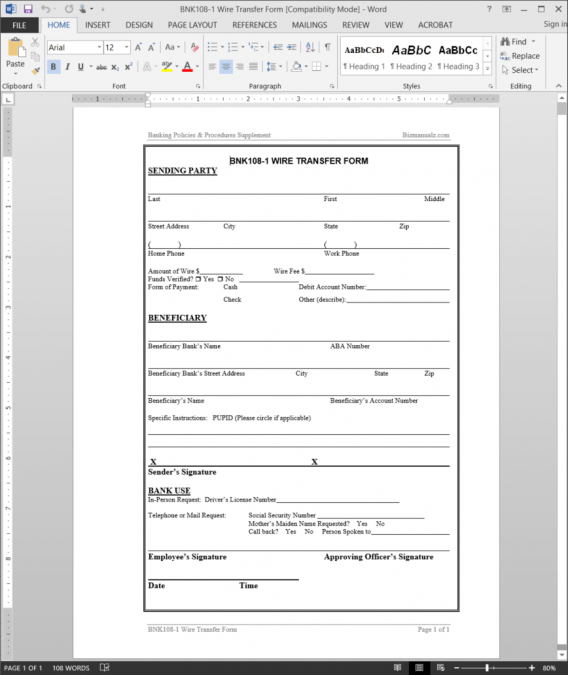

With signNow, you are able to design as many papers daily as you require at an affordable price. If you need to share the capitalone wire transfer with other parties, you can easily send it by electronic mail. Read more about usaa wire transfer information here. If you accept a check, ask for one drawn on a local bank that you can visit to determine … On using a particular form of payment and refuse requests to wire money.

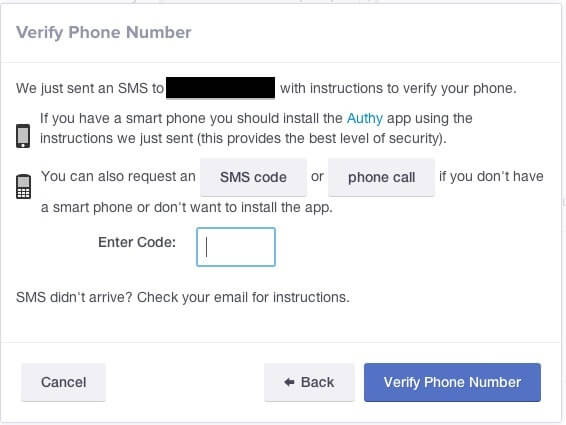

#CAPITAL ONE PHONE NUMBER TO WIRE MONEY CODE#

Ask your recipient to give you their SWIFT code when they provide their bank account details. You’ll usually need a SWIFT code when you’re sending an international payment. JPMorgan Chase, likewise, launched My Chase Plan and My Chase Loan in June 2019. The latter lets cardholders borrow from their credit card limit and repay in installments at a fixed APR.

0 kommentar(er)

0 kommentar(er)